Article

Strategic IP Considerations of Batteries and Energy Storage Solutions

Intellectual Property & Technology Law Journal

Authors

-

- Name

- Daniel A. Tishman

- Person title

- Principal

-

- Name

- Hyun Jin (HJ) In, Ph.D.

- Person title

- Principal

-

- Name

- Ralph A. Phillips

- Person title

- Principal

As the battery and electric vehicle (EV) industries continue to grow, in tandem the IP world is experiencing an increase in battery patenting activity. Fish principals Hyun Jin (HJ) In, Ph.D., Ralph Phillips, and Daniel Tishman explore these growing industries and offer considerations for companies protecting and defending their IP.

The lithium-ion battery, introduced commercially in 1991, revolutionized the consumer electronics industry. Compared with older battery technologies, the lithium-ion battery was lightweight and compact, had high energy density, and required little to no maintenance, making it the ideal battery for mobile devices. It now powers the world's most popular electronics, from smartphones to laptops to wearable devices. But the lithium-ion battery has now expanded far beyond the consumer electronics industry, sparking a gold rush of research and development aimed at producing lower-cost, higher-performance batteries that can be used in a wider range of applications. Over the past decade, developments in battery technology have led to rapid advances in the ubiquity of electric vehicles ("EVs") and opened up new possibilities for energy solutions that will help reduce dependence on fossil fuels. With these technical advances comes an increase in legal activity, including intellectual property ("IP") filings and litigation.

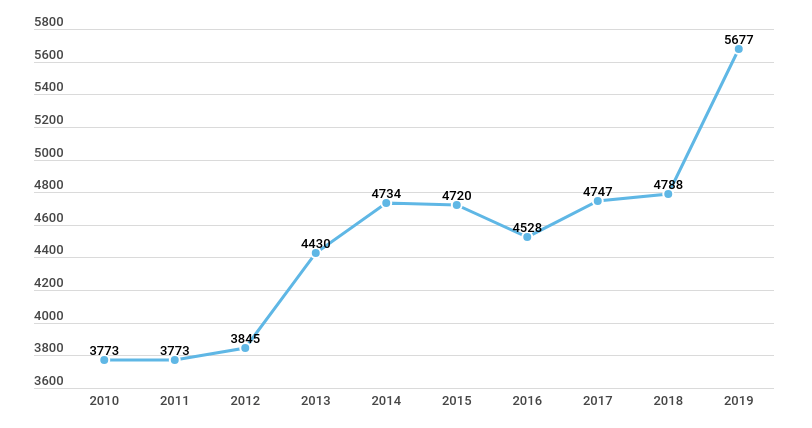

Research and development in the battery industry have led to a notable increase in patent filings at the U.S. Patent and Trademark Office ("USPTO"), climbing from 3,773 in 2010 to 5,319 in 2019 (see Figure 1). But as more players enter the market and obtain patent protection for their innovations, IP disputes among competitors are heating up. Global patent wars, safety concerns among the public, and scrutiny from government regulators are challenges that the battery industry must face head-on as it heads toward powering the future.

Figure 1: Battery Patent Filings: CPC Class H01M1

Battery Industry Growth and Trends

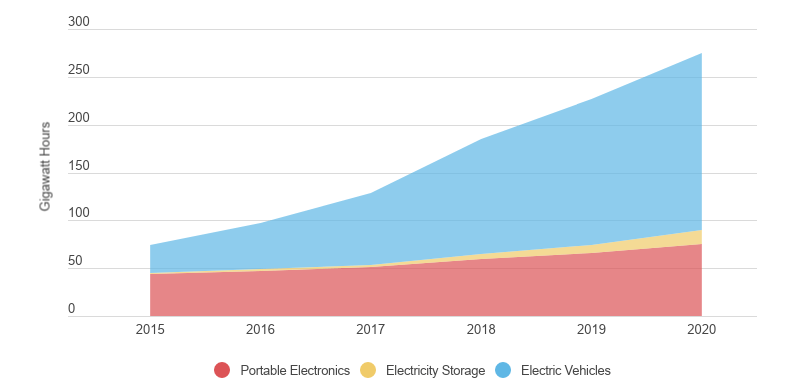

The global battery industry is in a period of rapid expansion. Valued at $108.4 billion in 2019 ($31.8 billion from the lithium-ion product segment alone), it is expected to grow at a compound annual growth rate of 14.1 percent through 2027.2 Factors influencing this growth include falling costs for components, strong demand for portable electronics, and increasingly strict emissions standards among developed nations. But the primary driver of growth in the battery sector is the EV industry, where demand already outstrips supply. Several large automakers, including Volkswagen and General Motors, have announced plans to phase out gasoline- and diesel-powered vehicles in the coming years, adding a sense of urgency to the race to develop efficient, cost-effective, and commercially viable battery technologies on a mass scale. See Figure 2 for global production of lithium-ion cells by usage.

Figure 2: Global Production of Lithium-Ion Cells by Usage3

The battery development race has the potential to transform not only the automotive industry but also the way we live. In the energy industry, batteries are increasingly being used to store excess energy when solar panels and wind turbines are producing electricity and to feed it back into the electrical grid when they are not, helping reduce reliance on fossil fuels to fill in production gaps. With continued development and scalability, mass deployment of energy storage could serve as a bridge to a clean-energy future, possibly rendering fossil fuels obsolete.4

The expansion of battery-related technology is also fueling significant growth in manufacturing investments and jobs in the United States and abroad. Advances in battery technology are leading to new jobs in the broader EV sphere as well as lithium-ion manufacturing jobs at plants throughout the country and around the world. For example, a recent trend has emerged whereby major battery companies and automakers are teaming up to form joint ventures, including car companies such as Tesla, GM, and Ford teaming up with battery manufacturers to bring jobs to the United States and to help supply this ever-growing industry.5

In the coming years, while lithium-ion battery technology will continue to grow along with the market for EVs, consumer products, and home energy storage solutions, new technologies, including "solid-state batteries," are making waves. Solid-state batteries replace the liquid electrolyte in batteries with a technology that is said to be safer, more efficient (i.e., higher energy density), and more durable than lithium-ion batteries.6 The potential impact of solid-state batteries on the EV industry in particular is huge, as they hold significantly more energy and charge in less time than traditional lithium-ion batteries, thereby eliminating one of the perceived drawbacks of EV ownership.7 And with President Joe Biden's recent executive order setting a target for zero-emissions vehicles to account for half of all automobiles sold in the United States by 2030, solid-state battery development likely will kick into even higher gear over the course of the decade.8

Policy Considerations

The regulatory landscape surrounding lithiumion batteries and EVs is complex and focuses mainly on regulations encouraging the widespread adoption of EV technology, along with regulations addressing safety and environmental concerns. A number of policies are gaining support within the United States and internationally, encouraging a shift away from fossil fuels propelling the growth of the EV industry (the largest market for batteries). For example, President Biden's executive order, in addition to setting a goal of 50 percent EV market share by 2030, is "part of the administration's broader agenda to tackle climate change and compete with China."9 The administration has further introduced an infrastructure bill that addresses EVs head on, setting out to "[b]uild a national network of EV chargers along highways and in rural and disadvantaged communities," constituting the "largest investment in EV infrastructure in history" and moving toward "the President's goal of building 500,000 EV chargers."10 At the same time, numerous states and countries — including California, Canada, China, France, Japan, the United Kingdom, and many others — have announced plans to phase out fossil fuel vehicles.11 Moreover, the Environmental Protection Agency ("EPA") and other environmental regulators have developed fuel economy standards for expressing driving range, charge times, miles-pergallon equivalents, and other metrics.12

Battery Technology Overview

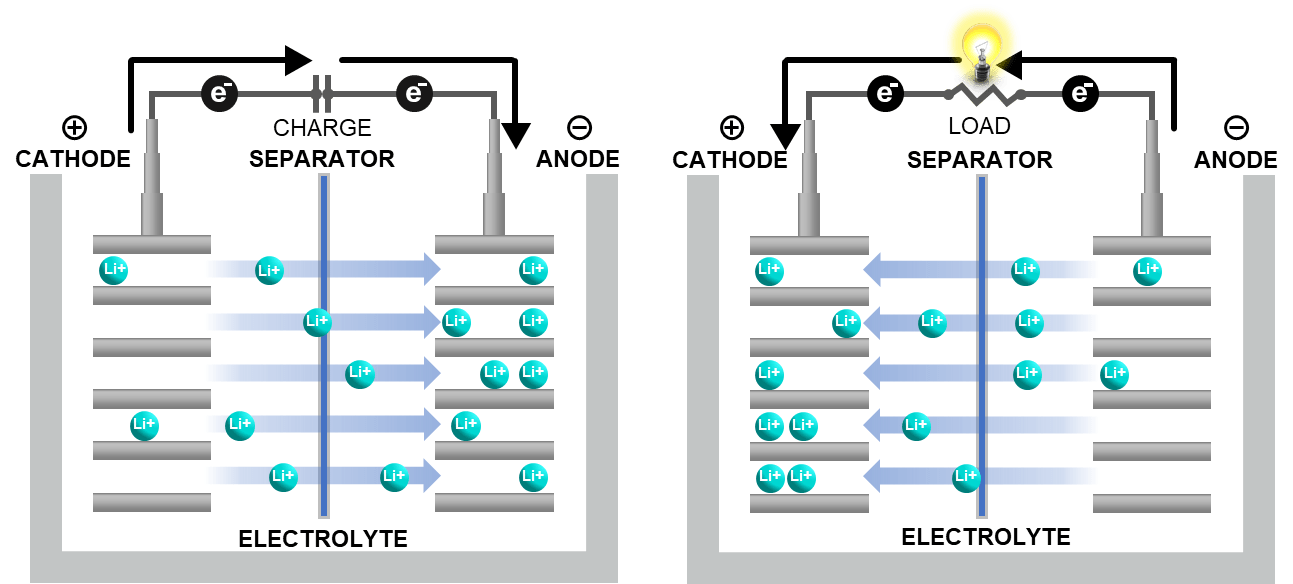

At their core, batteries are energy-storage devices, including a positive electrode (a cathode), a negative electrode (an anode), an electrolyte, and a separator — all of which are covered by patents, trade secrets, and other forms of intellectual property.

When lithium-ion batteries are charged and discharged, there is a movement of ions between the electrodes, during which lithium ions travel from the cathode through the electrolyte to the anode. As illustrated above, during the charge and discharge process, the separator provides an insulating barrier between the electrodes to prevent the electrodes from making contact and resulting in a short circuit.

The basic unit is called a cell (including the electrodes, separator, and electrolyte in a package). An assembly of battery cells can form a battery module, and in the context of EVs, cells can be organized into multiple modules, or a pack.

In recent years, there have been a number of high-profile litigations in the United States involving patents directed to each of the above-referenced components, including patent litigations related to cathodes,13 anodes,14 separators,15 electrolytes,16 battery cell packaging,17 and battery module packaging.18

In fact, although most battery patents relate to technical features of a battery, a recent lawsuit related to design patents addresses a specific visual battery pack housing.19 Ancillary technologies have likewise seen a spike in patent litigation activity in recent years, including charging technologies and battery control systems (e.g., battery management systems that control the recharging of batteries based on the state of charge, temperature, etc.),20 although such technologies may face additional hurdles related to the prohibition on patenting abstract ideas.21

Intellectual Property Considerations

IP affects every industry, and the battery industry is no different. IP includes any creation of the mind, including inventions, literary and artistic works, symbols, names, images, and designs, and various forms of IP protection cover these different categories. For example, patents protect inventions, whereas copyrights protect written or recorded expressive content; trademarks protect words, symbols, logos, designs, and slogans that identify or distinguish products or services; and trade secrets protect confidential business information. Protection of IP through patents and trade secrets is an important consideration in the battery industry, where market participants are constantly striving to improve battery performance and methods of manufacture. But patent holders must also beware of challenges from competitors and demands for interoperability from consumers. A comprehensive IP strategy must cover all bases prosecution, enforcement, defense, and transactions.

Patent Prosecution, Portfolio, and Strategic Patenting Considerations

A patent is a grant of property from the government of the right to exclude others from making, using, offering to sell, selling, or importing the invention claimed in the patent. Although the power to enforce this right depends on the circumstances, patents offer an important competitive tool.

Patents have contributed significantly to the advances in science and technology that make lithium-ion batteries more affordable and efficient today. There has been a sharp increase in battery patenting activity over the past few years, as noted elsewhere. Most of that activity has been focused on improvements to existing technologies, such as innovations in next-generation materials and components, films and coatings, electrolyte solutions, and fabrication techniques, among many others. But avenues for groundbreaking innovation continue to open up, particularly in the solid-state battery space.22 For example, Ford and BMW announced in May 2021 that they had invested $130 million in solid-state battery startup Solid Power to deliver batteries that will be deployed in EVs by 2030.23 Competition among disruptive startups seeking the next breakthrough, as well as small-scale improvements to existing lithium-ion technologies, are driving battery patenting activity not only in the USPTO but also in the federal district courts and the International Trade Commission ("ITC") — each of which has seen increased battery litigation activity in recent years.

Obtaining patent protection for battery innovations requires battery companies to file patent applications with the USPTO. While patent prosecution can be onerous for any company, there is some evidence that battery companies generally face fewer obstacles to obtaining patents than other companies in the EV sphere, particularly those developing driverless AI technologies. Unlike AI and other software-based innovations, batteries typically do not raise subject matter eligibility issues, thereby avoiding a hurdle to patent protection that is common in other corners of the EV industry. The 2019 average allowance rate in CPC Class H10M was 82 percent, which is actually higher than the overall USPTO average for all technologies.24 Some of the most active companies are LG Chem, Toyota, Samsung SDI, Hefei Guxuan High-Tech Power Energy, Panasonic, BYD, CATL, SK Innovation, Envision, Tesla, Wildcat Discovery Technologies, and QuantumScape.25

Battery and EV companies should focus on patent strategy beyond prosecution and enforcement. Companies should align their patent strategy with their overall business plan to ensure that a patent portfolio realizes its full economic potential and generates revenue for the company by protecting investments. Strategic considerations include what to patent (battery management systems, battery components, cell assembly, manufacturing processes, or components), where to patent, what patents to abandon or sell, and licensing strategies.

One key strategic consideration in building a robust patent portfolio involves deciding in which countries to file the patent applications. With attorney fees, filing fees, potential translation fees (if filing in a non-English language jurisdiction), and annuity fees, among others, the costs of obtaining and maintaining a global patent portfolio can quickly add up. A popular option, especially in cases where it is not yet clear in which specific countries IP protection is needed, is to first file a Patent Cooperation Treaty ("PCT") application. A PCT application, which by itself does not provide any IP protection, provides an opportunity to later enter the national phase in designated countries/regions, namely by pursuing the patent application before the individual patent offices of designated countries/regions to obtain patent protection in those countries/regions. As for which countries to file in, be it through the PCT or direct filing approaches, there are several factors to consider, including costs and relative ease/difficulty of filing and prosecution, length of examination/ time to grant, quality of examination, and the ability to enforce one's patents once they are obtained. For battery-related patents in particular, it is important to consider where and how big the present markets are for the invention.

Additionally, one should ask several other important questions: Where are the customers located? Where is the competition located, and where does it manufacture its products? Where will the customers/ competition be five, 10, or 15 years from now? Not surprisingly, the European Union, the United States, China, and Japan are popular options, although South Korea is another strong choice for battery-related technology given the large number of battery innovators that are based there.

Another key consideration involves deciding what aspect of the battery to patent: the entire system or specific components? Key materials such as anodes and cathodes? Perhaps specific manufacturing process?

While there is not a one-size-fits-all approach, it is worth keeping in mind that (1) proving infringement of a manufacturing process can be difficult, and (2) a patent that is directed to a larger system with many different components can be easier for a competitor to design around in order to avoid infringement. Because each aspect is likely to require its own separate patent application, such decisions must be made carefully. Battery companies evaluating their IP strategy in the United States should also consider importation and supply chains, as a patent can serve as a tool to prevent importation (e.g., through enforcement at the ITC).

While lithium-ion batteries continue to dominate, solid-state batteries are being carefully studied as a potentially safer alternative with higher energy density, as mentioned above. Solid-state batteries are batteries that use solid electrodes and a solid electrolyte instead of the traditionally liquid or polymer gel electrolytes used in lithium-ion batteries. With a rise in research and development, so too comes a rise in patent filings and activity as competitors race to improve the technology and make it cheaper. Patent filings associated with this emerging technology are dominated by many of the same companies that lead in overall battery patent filings, including Toyota, LG Chem, Panasonic, BYD, Samsung SDI, and CATL, to name a few.26

IP Enforcement and Litigation Considerations

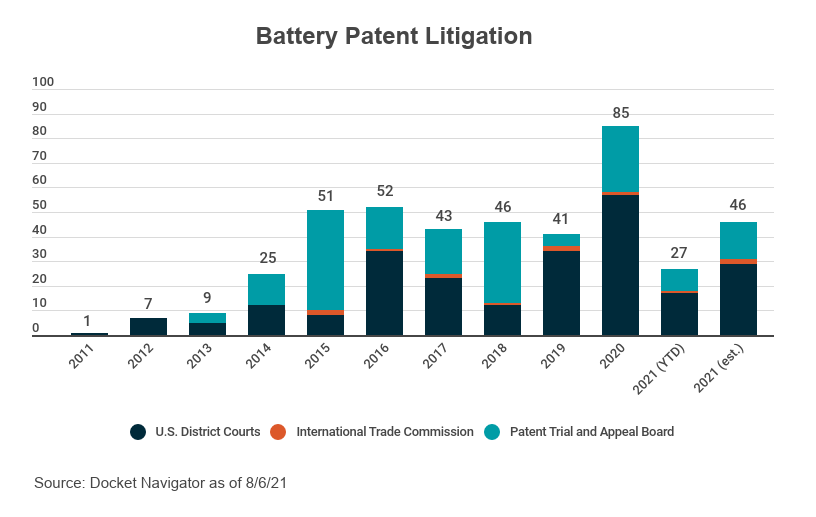

Due to fierce competition and rapid growth in the battery sphere, it is no surprise that IP litigation is seeing commensurate growth. Up from just 10 cases involving patents related to battery technologies in 2011,27 in 2020 alone there were 93 such cases in U.S. district courts, the U.S. Patent Trial and Appeal Board, and the U.S. International Trade Commission. As of the date of this article, there have been 47 such cases in 2021, and that number was projected to reach 61 by the end of last year, as illustrated in the accompanying graph.28

The past few years have seen a flurry of activity in patent and trade secret litigation between battery manufacturers29 and component suppliers30 in high-stakes competitor-on-competitor litigations. Indeed, from 2019 through 2021, LG Chem and SK Innovation engaged in a series of litigations, including three ITC investigations and numerous district court and Patent Trial and Appeal Board ("PTAB") proceedings involving batteries, battery modules, separators, cathode materials, and more. The litigation caught the attention of the entire industry, and the Biden administration, at a time when President Biden introduced a $2 trillion infrastructure plan with $174 billion earmarked for EVs specifically.31 With intense competition and widespread patent filings, the industry is sure to see more battery wars in the years to come, including litigation among battery companies, EV companies, component suppliers, and companies making or selling battery modules, packs, and charting technologies. To date, however, the industry has not seen significant litigation campaigns from nonpracticing entities.

There are many details that battery companies should consider when seeking to initiate patent litigation or when faced with a lawsuit. First, companies seeking an injunction should be aware that there are limitations on when a district court can issue an injunction, based on the seminal eBay v. MercExchange case:

- A plaintiff must demonstrate: (1) that it has suffered an irreparable injury; (2) that remedies available at law, such as monetary damages, are inadequate to compensate for that injury; (3) that, considering the balance of hardships between the plaintiff and defendant, a remedy in equity is warranted; and (4) that the public interest would not be disserved by a permanent injunction.32

A proceeding under Section 337 at the ITC can offer import bans for companies that can prove infringement and can prove that a domestic industry exists with respect to the patented article. When considering the ITC, although there are many different ways to satisfy the domestic industry requirement, a patent holder should ideally target patents covering articles that it uses in United States manufacturing or assembly activities and which an alleged infringer cannot easily purchase in the United States. Moreover, with ever-increasing attention on green energy, patent holders should be mindful of public interest concerns — whether in the district court (under the fourth eBay factor) or in the ITC (in which public interest is relevant to remedy determinations). For example, a patent holder that has the ability to meet demand for any competitor it may displace will be better positioned to overcome public interest challenges.

Second, battery companies seeking to assert their patents, or accused infringers, should be mindful of the basics of patent damages. Section 284 of the patent statute provides that a patentee is entitled to damages adequate to compensate for any infringement and "in no event less than a reasonable royalty for the use made of the invention by the infringer."33 The two primary methods of calculating damages are actual damages (e.g., lost profits, primarily reserved for two competitor industries) and a "reasonable royalty," typically based on the hypothetical negotiation framework that asks what a willing licensor and a willing licensee would have agreed to just before the time of first infringement. Other methodologies look to the infringer's profit projections and attempt to apportion the projected profits between the parties as a percentage of sales or look to the cost savings of adopting the patented technology. Damages models associated with extending battery life or the range of an EV have a potential to yield significant royalties.

Battery companies should also be mindful of the patent "marking" requirement, whereby a patent owner is required to mark its product with the number of a patent that covers the product in order to avoid a limitation on damages under Section 287 of the patent statute.34 Battery companies should additionally be aware of the dramatic increase in trade secret cases since the 2016 passage of the Defend Trade Secrets Act ("DTSA"), which seeks to achieve a single national standard for trade secret misappropriation. Trade secret protection is available for a broad range of technologies relevant to the battery industry, including recipes and manufacturing processes; those relevant to cell, module, or pack assembly; and those relevant to components (e.g., electrodes, separators, and electrolytes).

A trade secret is information that derives economic value from not being generally known or readily ascertainable and that has been the subject of reasonable efforts to maintain its secrecy (in contrast to patents, which require public disclosure of the invention in exchange for a right to exclude others from exploiting the invention). For this reason, patent and trade secret protection cannot be used simultaneously to cover the exact same aspects of the exact same invention — because patents are published, the public disclosure necessarily destroys the requisite secrecy for trade secret protection.

Trade secret misappropriation can occur in a variety of ways, such as when former employees take proprietary information and disclose it to their new employer or when confidential information is exchanged (e.g., under a non-disclosure agreement) and used in a way that violates an agreement. Trade secret litigation can involve a daunting amount of discovery and can yield significant damages. A recent trade secret misappropriation case in the ITC resulted in an order excluding a company from the United States, and it was resolved through a significant settlement in the billions of dollars, as widely reported in the press.35Â Moreover, trade secret misappropriation can lead to criminal exposure under state and federal law.

Therefore, battery companies should take serious care to avoid using information that may have been improperly obtained and to protect their own trade secrets with reasonable measures that go beyond normal business practices. "[A]n employer must use additional measures to protect the confidentiality of information he considers to be a trade secret," including, for example, negotiating confidentiality agreements, limiting access to documents, restricting access to buildings or rooms, and denoting documents as confidential.36

Although this article focuses on litigation and IP protection in the United States, enforcement abroad is gaining traction as well. For example, in May 2020, the United Kingdom's High Court of Justice granted an injunction barring Shenzhen Senior Technology Material Co. from importing battery separators,37 and in July 2021, Chinese EV battery supplier CATL sued Chinese competitor CALB in China for patent infringement.38

Standard Setting Organizations and Patent Pools

There are a number of standard setting organizations ("SSOs") relevant to the lithium-ion battery industry that develop and promulgate voluntary battery standards as well as certify that particular batteries comply with them. These include the Underwriters Laboratories ("UL"), the Institute of Electrical and Electronics Engineers ("IEEE"), the American National Standards Institute ("ANSI"), and the Society of Automotive Engineers ("SAE"). Each SSO issues different standards for different types of battery products. For example, UL 1642 is a standard for safety for lithium batteries, IEEE 1725 is a standard for rechargeable batteries for mobile phones, and SAE J 2929 is a standard for electric and hybrid vehicle propulsion battery system safety.

However, to date, the battery industry has not seen standards to enable connectivity (e.g., with respect to charging) or to allow for batteries to be transferred to different EVs — including those made by other companies. Without collaboration between various battery companies and automakers to ensure interoperability, the industry risks becoming siloed into noncompatible ecosystems. The development of such standards may lead to Standards Essential Patents ("SEPs") and fair, reasonable, and nondiscriminatory ("FRAND") licensing obligations. Implementation of standards to allow increased collaboration between companies may help advance the widespread implementation of EVs and reduce range anxiety among consumers. For example, Tesla's CEO Elon Musk has announced that the company's fast-charging stations (the Tesla Supercharger network) will open up to other EV makers.39 While cooperation among industry players through standardization and patent pools can help boost EVs into the mainstream, companies should be mindful of potential antitrust issues if they lead to "anticompetitive effects" such as "price fixing, coordinated output restrictions among competitors, or foreclosure of innovation."40 As the EV market grows, consumers will increasingly demand standardization and interoperability, and SEPs and FRAND licensing considerations will become vital components of many companies' patent portfolios and IP strategies.

Conclusion

With the spike in economic growth in the battery industry and the EV industry, the IP world is seeing a commensurate spike in battery activity. For example, battery-related patent filings are gaining speed, as are litigations involving battery patents. This growth is expected to continue in the coming years, and companies should be prepared to protect their own IP as well as defend themselves against IP enforcement actions from rivals and nonpracticing entities. Battery companies, EV companies, and suppliers should carefully evaluate their IP policies and practices to best position themselves competitively.

Notes

1. H01M: Processes or Means, e.g. Batteries, For The Direct Conversion of Chemical Energy Into Electrical Energy, Source: Juristat as of 8/17/21.

2. https://www.grandviewresearch.com/industry-analysis/battery-market.

3. Gold, Russell, and Ben Foldy, "The Battery Is Ready to Power the World." The Wall Street Journal, Feb. 5, 2021, www.wsj.com/articles/the-battery-is-ready-to-power-theworld-11612551578.

4. https://www.bbc.com/future/article/20201217-renewablepower-the-worlds-largest-battery.

5. https://www.cnbc.com/2019/12/30/battery-developmentsin-the-last-decade-created-a-seismic-shift-that-will-play-outin-the-next-10-years.html.

6. https://www.autoweek.com/news/technology/a36189339/solid-state-batteries/.

7. https://news.harvard.edu/gazette/story/2021/05/researchers-design-long-lasting-solid-state-lithium-battery/.

8. https://www.whitehouse.gov/briefing-room/statementsreleases/2021/08/05/fact-sheet-president-biden-announcessteps-to-drive-american-leadership-forward-on-clean-cars-andtrucks/.

9. https://www.usatoday.com/story/news/politics/2021/08/05/president-joe-bide-zero-emissions-vehic les-2030-goal/5489643001/.

10. https://www.whitehouse.gov/briefing-room/statementsreleases/2021/06/24/fact-sheet-president-biden-announcessupport-for-the-bipartisan-infrastructure-framework/.

11. https://thedriven.io/2020/11/12/the-countries-and-statesleading-the-phase-out-of-fossil-fuel-cars/.

12. https://www.epa.gov/fueleconomy/interactive-versionelectric-vehicle-label.

13. See, e.g., LG Energy Solution, Ltd. et al. v. SK Innovation Co., Ltd. et al., No. 1-19-cv-01805 (D. Del.).

14. See, e.g., CF Traverse LLC v. Amprius, Inc., No. 3-20-cv-00484 (N.D. Cal.).

15. See, e.g., LG Energy Solution, Ltd. et al. v. SK Innovation Co., Ltd. et al., No. 1-19-cv-01805 (D. Del.).

16. See, e.g., Advanced Electrolyte Techs. LLC et al. v. BYD Lithium Battery Co., Ltd., No. 1-20-cv-00687 (W.D. Tex.).

17. See, e.g., SK Innovation Co., Ltd. v. LG Chem, Ltd. et al., No. 1-19-cv-01638 (D. Del.).

18. See, e.g., SK Innovation Co., Ltd. v. LG Chem, Ltd. et al., No. 1-19-cv-01637 (D. Del.).

19. See Certain Batteries and Products Containing the Same, Inv. No. 337-TA-1244 (U.S.I.T.C.).

20. See, e.g., Somaltus, LLC v. Noco Co., No. 1-17-cv-1111 (N.D. Ohio).

21. See, e.g., ChargePoint, Inc. v. SemaConnect, Inc., 920 F.3d 759 (Fed. Cir. 2019).

22. https://www.wsj.com/articles/solid-power-quantumscapeand-the-battle-for-next-generation-batteries-11623847059.

23. https://www.caranddr iver.com/news/a36321196/bmw-ford-solid-state-battery-investment-announced/.

24. Source: Juristat as of 07/16/2021.

25. https://www.iam-media.com/patents/inside-the-patent-holdings-of-the-companies-the-cutting-edge-of-battery-technology.

26. Id.

27. The statistics regarding cases involving a patent related to battery technology in this section refer to cases involving any patent that references "battery," "anode," "cathode," "separator," "electrode," or "electrolyte," with false positives eliminated.

28. Source: Docket Navigator as of 10/8/21.

29. For example, in 2017, battery supplier LG Chem sued Amperex Technology Ltd. and filed a complaint in the ITC regarding batteries and composite separators. Certain Batteries and Electrochemical Devices Containing Composite Separators, Components Thereof, and Products Containing the Same, Inv. No. 337-TA-1087 (U.S.I.T.C.).

30. For example, in 2015, cathode supplier BASF sued Umicore and filed a complaint in the ITC regarding lithium metal oxide cathode materials. Certain Lithium Metal Oxide Cathode Materials, Inv. No. 337-TA-951 (U.S.I.T.C.).

31. https://www.npr.org/2021/04/11/986234531/southkorean-electric-vehicle-battery-makers-reach-1-8b-deal-toend-trade-dispute.

32. eBay Inc. v. MercExchange, L.L.C., 547 U.S. 388, 391 (2006) (citations omitted).

33. 35 U.S.C. § 284: Upon finding for the claimant the court shall award the claimant damages adequate to compensate for the infringement, but in no event less than a reasonable royalty for the use made of the invention by the infringer, together with interest and costs as fixed by the court. When the damages are not found by a jury, the court shall assess them. In either event the court may increase the damages up to three times the amount found or assessed. Increased damages under this paragraph shall not apply to provisional rights under section 154(d). The court may receive expert testimony as an aid to the determination of damages or of what royalty would be reasonable under the circumstances.

34. 35 U.S.C. § 287(a): Patentees, and persons making, offering for sale, or selling within the United States any patented article for or under them, or importing any patented article into the United States, may give notice to the public that the same is patented, either by fixing thereon the word "patent" or the abbreviation "pat.," together with the number of the patent, or by fixing thereon the word "patent" or the abbreviation "pat." together with an address of a posting on the Internet, accessible to the public without charge for accessing the address, that associates the patented article with the number of the patent, or when, from the character of the article, this can not be done, by fixing to it, or to the package wherein one or more of them is contained, a label containing a like notice. In the event of failure so to mark, no damages shall be recovered by the patentee in any action for infringement, except on proof that the infringer was notified of the infringement and continued to infringe thereafter, in which event damages may be recovered only for infringement occurring after such notice. Filing of an action for infringement shall constitute such notice.

35. Certain Lithium Ion Batteries, Inv. No. 337-TA-1159 (U.S.I.T.C.); https://www.bloomberg.com/news/articles/2021-04-10/ford-vw-battery-supplier-said-to-reach-deal-toavoid-import-ban.

36. Starsurgical Inc. v. Aperta, LLC, 40 F. Supp. 3d 1069, 1082 (E.D. Wis. 2014).

37. https://www.prnewswire.com/in/news-releases/unitedkingdom-high-court-of-justice-grants-celgard-an-interim-injunction-against-senior-preventing-the-importation-ofbattery-separators-into-the-uk-879605455.html.

38. https://www.iam-media.com/litigation/china-batterypatent-litigation.

39. https://www.cnbc.com/2021/07/20/elon-musk-says-teslawill-open-its-chargers-to-other-electric-vehicles.html.

40. https://www.justice.gov/atr/chapter-3-antitrust-analysisportfolio-cross-licensing-agreements-and-patent-pools.

The opinions expressed are those of the authors on the date noted above and do not necessarily reflect the views of Fish & Richardson P.C., any other of its lawyers, its clients, or any of its or their respective affiliates. This post is for general information purposes only and is not intended to be and should not be taken as legal advice. No attorney-client relationship is formed.

Blog January 21, 2025

How Standardization, SEPs, and Patent Pools Can Benefit the EV and Battery Industries

Blog November 22, 2024

Director Review Spotlight: Multiple Dependent Claims

Blog October 15, 2024

Recapping a Busy Summer for Director Review

Article January 4, 2023

ITC Year in Review

Blog September 14, 2022

ITC Monthly Wrap-Up: August 2022

Article August 25, 2022

Two ITC Investigations Highlight Different Avenues for Early Disposition

Blog June 13, 2022

ITC Monthly Wrap-Up: May 2022 — Two Investigations Highlight Different Avenues for Early Disposition

Article December 13, 2021

Powering up

Blog October 5, 2021

ITC Monthly Wrap-Up: September 2021

Blog December 22, 2025

5 in ‘25: International Trade Commission

Blog December 17, 2025

Texas Round-Up: November 2025

Article December 15, 2025

Federal Circuit Declines To Disturb “Settled Expectations” Factor in Denying Mandamus Petitions

Blog December 10, 2025

USPTO Adds Desjardins to MPEP Subject Matter Eligibility Guidance

Blog December 8, 2025

USPTO Urges Separate Filing of Subject Matter Eligibility Declarations

Blog November 17, 2025

ITC Round-Up: Q3 2025

Blog November 12, 2025

Unpacking Appellate Challenges to the USPTO’s Discretionary Denial Framework

Blog November 7, 2025

Standard Essential Patents: Life Cycle Overview

Blog November 5, 2025

Texas Round-Up: September 2025

Article October 28, 2025

What To Know About Interim Licenses In Global FRAND Cases